Will upstream raw material companies be affected as the 2025 IVD centralized procurement expands to molecular diagnostics

Release time:

2025-10-15

Under the continuous influence of industry policy dynamics, the scope of centralized procurement in the field of in vitro diagnostics (IVD) will be further expanded to include molecular diagnostics by 2025. This measure has attracted widespread attention from both upstream and downstream of the industrial chain, especially upstream raw material enterprises, whose development trend under the new policy framework has attracted much attention. Molecular diagnostics, as a high-tech and rapidly developing sub field in the IVD industry, will have a profound impact on upstream raw material enterprises from multiple dimensions through the expansion of centralized procurement.

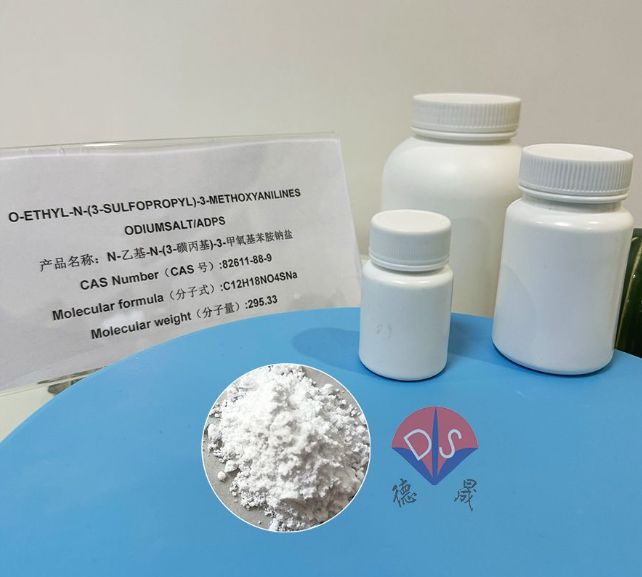

Chromogenic substrate ADPS

The transformation of the molecular diagnostic market under the expansion of centralized procurement

Molecular diagnosis, with its accurate detection characteristics, is widely used in various fields such as disease diagnosis, genetic disease screening, and cancer gene testing, and its market size continues to grow. The market size of molecular diagnostics at home and abroad is expected to reach approximately $16 billion in 2023, and is projected to grow to $19.561 billion by 2024. With the expansion of centralized procurement, the terminal prices of molecular diagnostic products will face downward pressure. In the past, the high prices of some molecular diagnostic reagents limited their popularity. Centralized procurement promotes the return of product prices to a reasonable range by exchanging quantity for price. For example, in some IVD centralized procurement projects that have been carried out, the prices of products such as chemiluminescence reagents have decreased by more than 50%. After molecular diagnostic reagents enter centralized procurement, there may also be significant price reductions to improve product accessibility and benefit more patients. The market landscape will also be reshaped accordingly. The winning bidder of centralized procurement is expected to rapidly expand its market share by leveraging its price advantage and stable supply. Top enterprises have a greater advantage in centralized procurement competition due to their economies of scale and cost control capabilities. However, some small and medium-sized enterprises may face the risk of shrinking market share or even being eliminated due to their inability to meet centralized procurement requirements or bear price pressure.

The direct impact faced by upstream raw material enterprises

1. Significant pressure on price transmission

Upstream raw material enterprises are first facing price pressure. Raw materials account for a significant proportion of the cost of molecular diagnostic reagents. After centralized procurement, the terminal prices of reagents have decreased, and midstream reagent production enterprises will inevitably transmit cost pressure to the upstream in order to maintain profit margins. Raw material companies may be forced to lower product prices, resulting in a narrower profit margin. According to relevant data statistics, in the fields involved in IVD centralized procurement in the past, the average price of upstream raw materials decreased by 15% -30%.

2. Increased fluctuations in order demand

The uncertainty of the bidding results for centralized procurement has intensified the fluctuations in order demand for upstream raw material enterprises. If a reagent production enterprise fails to win the bid for centralized procurement, its production capacity will be significantly reduced, and the amount of raw material procurement will also decrease accordingly. On the contrary, if the winning bidder significantly expands its production capacity to meet the demand for centralized procurement, it may also experience a surge in demand for raw materials in the short term. The significant fluctuations in order demand pose challenges to the production planning and inventory management of upstream raw material enterprises. Raw material enterprises find it difficult to accurately predict market demand, which may result in overproduction or insufficient supply, increasing operating costs and the risk of stockouts.

Response of upstream raw material enterprises

1. Cost control and efficiency improvement

Raw material enterprises need to optimize internal management and reduce operating costs. In the procurement process, establish long-term stable cooperative relationships with suppliers, and reduce raw material procurement costs through centralized procurement, signing long-term contracts, and other methods. In the production process, advanced production technology and equipment are introduced to optimize the process flow, improve production efficiency, and reduce waste of manpower and material resources. Strengthen quality management, reduce the rate of defective products, and avoid cost increases caused by quality issues. By refining cost control, enterprises can enhance their flexibility in price competition.

2. Technological innovation and product diversification

Continuously investing in research and development to enhance the technological content and quality level of products is the core strategy for enterprises to respond to challenges. On the one hand, technological upgrades should be made to existing raw material products to improve product performance and stability, meeting the higher quality requirements of molecular diagnostic reagents for raw materials. On the other hand, expanding product categories and developing diversified raw material product lines. In addition to meeting the raw material requirements of mainstream molecular diagnostic technology, we will also lay out the research and development of raw materials in emerging technology fields, seize market opportunities in advance, and reduce dependence on a single product or technology.

3. Supply chain optimization and strengthened cooperation

To build a stable and flexible supply chain system, raw material enterprises should strengthen cooperation and collaboration with upstream and downstream enterprises, establish deep strategic partnerships with reagent production enterprises, and jointly respond to market changes brought about by centralized procurement. By sharing information, we can gain advance understanding of the production plans and demand changes of reagent companies, and arrange production and inventory reasonably. At the same time, expanding raw material supply channels, reducing dependence on a single supplier, and ensuring stable supply of raw materials. For enterprises with conditions, it is possible to consider extending the industrial chain upstream, achieving independent production of some key raw materials, and enhancing the controllability of the supply chain.

Previous page

Previous page

News

Contact details

Contact number

Address: C8, Guanggu United Science and Technology City, Ezhou City, Hubei Province

Fax:0711-3704 589

Follow us